San Antonio-based Jefferson Bank began offering Card Alerts to its banking customers in early February.

San Antonio-based Jefferson Bank began offering Card Alerts to its banking customers in early February.

When customers use a Jefferson Bank Visa® Check Card to make a purchase, they receive instant confirmation of the purchase, through text messages and/or email, allowing cardholders to monitor their spending and check legitimate activity, reducing fraud. Jefferson Bank is the first community bank in San Antonio to partner with Visa to provide these instant card alerts to its customers.

When customers use a Jefferson Bank Visa® Check Card to make a purchase, they receive instant confirmation of the purchase, through text messages and/or email, allowing cardholders to monitor their spending and check legitimate activity, reducing fraud. Jefferson Bank is the first community bank in San Antonio to partner with Visa to provide these instant card alerts to its customers.

“With so many transactions occurring, and with card fraud on the rise,we wanted to offer our customers peace of mind while they are shopping,” said Sarah Booker, Vice President and Card Services Officer, Jefferson Bank. “Other financial institutions have bank account alerts, or e-banking alerts, but none solely for the use of the debit check card, and Jefferson Bank is committed to providing its customers’ with this added safety and security measure.”

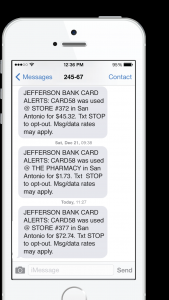

Cardholders receive alerts through text messages on their mobile phone or via e-mail on their tablet, computer or mobile phone. For added security, cardholders can choose to receive both text and e-mail. Information received includes purchase amount, merchant name and location (if available) and the last four digits of the Visa card used (see image).

Customers using the Jefferson Bank Visa Check Card also receive customized transaction alerts for purchases made online, over the phone or through the mail. Alerts will also be provided for cash withdrawals at an ATM (only for international ATM/PIN transactions) and if purchases are made outside the United States.

“We have received so many positive reactions and complimentary feedback from our customers who have taken advantage of this free service. We have had several cases of attempted fraud that have been blocked due to the Card Alerts service instantly notifying our customers,” Booker said. “Overall, Jefferson Bank Card Alerts has been a valuable service for both our customers and us. It’s another way that we maintain the responsiveness and commitment of customer service because, after all, This is personal to us!”

For more information, visit www.jeffersonbank.com or contact the Card Services Department at 210-734-4311.

About Jefferson Bank

Family-owned and operated, Jefferson Bank was established in 1946 and is the third largest San Antonio-based bank. Its Mission Statement is earning long term relationships every day through integrity, responsiveness and commitment. The company is actively involved in the community. In 2012, Jefferson Bank employees volunteered 4,277 hours of their time to 110 local organizations and non-profit groups. For more information, visit www.jeffersonbank.com.

Generations Federal Credit Union has announced the

Generations Federal Credit Union has announced the  Generations members can access Smart Deposit through the credit union’s mobile application which is available for Apple and Android-supported devices. To make a deposit, members simply select the Smart Deposit feature in the main menu, take a picture of the front and back of the check, select the account where the funds will be deposited and click submit.

Generations members can access Smart Deposit through the credit union’s mobile application which is available for Apple and Android-supported devices. To make a deposit, members simply select the Smart Deposit feature in the main menu, take a picture of the front and back of the check, select the account where the funds will be deposited and click submit. Security Service Federal Credit Union (SSFCU) announced that members can now deposit checks using their smart phones through the latest update of SSFCU’s myBranch mobile banking app for Android and iOS smartphones.

Security Service Federal Credit Union (SSFCU) announced that members can now deposit checks using their smart phones through the latest update of SSFCU’s myBranch mobile banking app for Android and iOS smartphones.