As tax season approaches, consumers are looking for opportunities to make better use of their IRS tax return deposits. One area financial institution working to encourage this trend is Generations Federal Credit Union, who announced the launch of their Return The Favor campaign.

As tax season approaches, consumers are looking for opportunities to make better use of their IRS tax return deposits. One area financial institution working to encourage this trend is Generations Federal Credit Union, who announced the launch of their Return The Favor campaign.

“A recent study indicates that nearly 40% of consumers plan on spending their return on a vacation or luxury item. It’s no secret that consumers need to save more – not just for that proverbial rainy day, but for their children’s college and their own retirement,” said Ashley Harris, VP of Corporate Communications for GFCU.

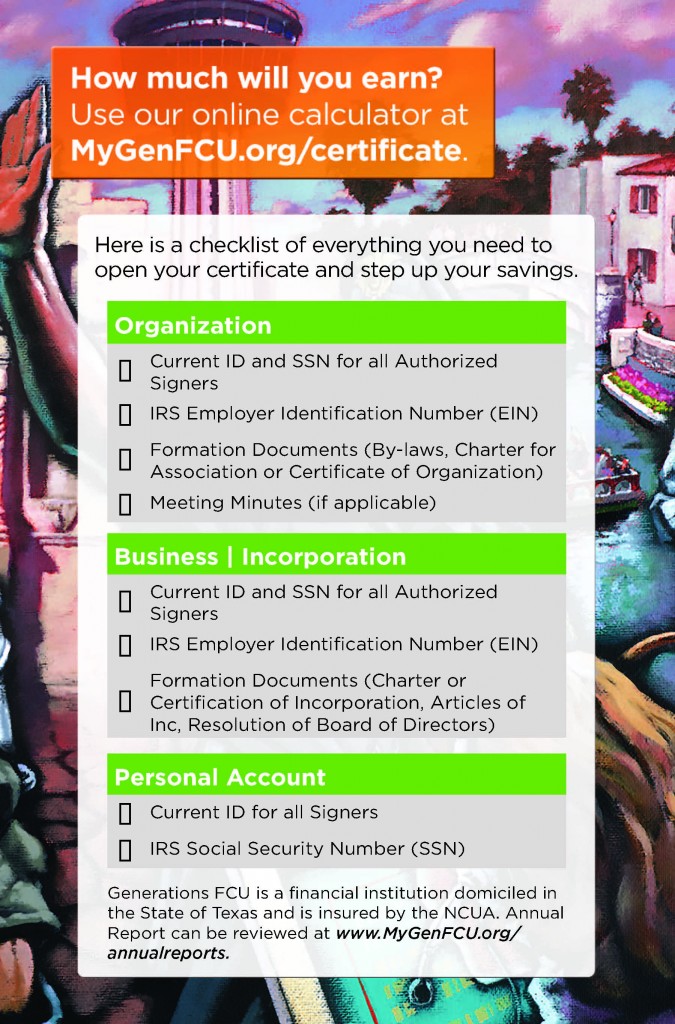

Return The Favor offers a 1.5% APY on a 14-month Term Share Certificate (the credit union equivalent of CDs) and/or IRAs between $10,000 and $99,999, and a 1.6% APY on a 14-month Term Share Certificate/IRA of $100,000 or more.

“We specifically designed this promotion to be the most competitive rate and term in the marketplace right now because we realize that if we are going to change patterns within consumer spending, than the returns need to be just as appealing as a 75-inch TV or trip to Cancun,” said Harris.

Another target audience of the Return the Favor campaign is municipalities and their investments which are governed by the Public Funds Investment Act and are limited to interest-earning accounts.

“Many municipalities are still suffering from a tax revenue decrease, and a major component of that is low interest earning rates,” observed Harris. “Just as CDs are guaranteed and insured, Term Share Certificates meet that same qualification and are a great opportunity for municipalities to get better rates for their own communities.”

This isn’t the first time the 74-year-old credit union has offered innovative options with regard to income tax returns. As part of their corporate outreach program, GFCU partnered with the City of San Antonio to launch RefundExpress in conjunction with the Volunteer Income Tax Assistance (VITA) program. A zero-interest, zero-fee Alternative Tax Refund Anticipation program, RefundExpress was targeted to the un-banked and under-served within Bexar County.

“The City approached us, very concerned about the growing trend of consumers losing their returns to high-interest, high-fee income tax preparers. We wanted to show other financial institutions that there was a benefit, beyond pure altruism, to being involved with the City and VITA,” said Harris.

The program was so successful that it was singled out by IRS Commissioner Richard Byrd who tasked his staff with determining how RefundExpress could be replicated by cities across the nation.

“It doesn’t matter if it’s a great rate on a Term Share Certificate or a campaign that connects with individuals who typically don’t save, any program that we can develop to encourage consumers to be financially savvy is something we are going to embrace,” concluded Harris.