House Passes Updated Heroes Act

October 1, 2020 | The House passed, on a 214 to 207 vote, an updated version of The Heroes Act, addressing needs that have developed since the House passed an earlier iteration and formalizing House Democrats’ proffer in ongoing negotiations between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin.

“The health and economic catastrophe facing our country continues to cry out for urgent action. The American people cannot afford to wait until next year for action, so House Democrats are making good on our offer to compromise,” said House Appropriations Committee Chairwoman Nita M. Lowey. “As negotiations continue, this updated version of The Heroes Act is a strong bill that meets the needs of the American people.”

To address needs that have arisen since the House first acted, the $2.2 trillion legislation includes strong support for small businesses, improving the Paycheck Protection Program and delivering targeted assistance to restaurants, nonprofits, and event venues; additional assistance for airline industry workers; and more funds to bolster education and child care.

In addition, the updated Heroes Act maintains key priorities from the legislation that passed the House in May. To that end, among its many provisions, the legislation provides strong support for our heroes on the frontlines with robust funding for state and local governments; invests in testing, tracing, and treatment; and puts more money directly in the pockets of workers and families through additional direct payments to cushion the economic blow of the coronavirus.

The updated Heroes Act is the House’s sixth piece of comprehensive legislation to respond to the coronavirus pandemic. The legislation follows the first iteration of The Heroes Act, which passed the House on May 15; the Paycheck Protection Program and Health Care Enhancement Act, enacted on April 24; the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted on March 27; the Families First Coronavirus Response Act, enacted on March 18; and the Coronavirus Preparedness and Response Supplemental Appropriations Act enacted on March 6.

The text of the revised version of The Heroes Act as introduced is here. A one-pager on the legislation as introduced is here. A section-by-section summary of the legislation as introduced is here. Additional information on the state and local relief provisions of the legislation as introduced is here.

###

- Other PPP ProvisionsWhile Chairman Rubio proposed a new total loan amount of $2 million for any borrower, the small business language within the HEALS Act also improves several aspects of the PPP and would, among other provisions:

- Establish new and existing funding of $190 billion;

- Reauthorize the PPP until December 31, 2020, as called for in ASAE’s July 21 letter;

- Expand eligible uses for non-payroll funds, up to 40 percent of a total loan, including for use on personal protective equipment; and

- Simplify the application process for PPP loans of $150,000 or less, as called for in ASAE’s July 21 letter (Review the summary.)

The bill also proposes a new “second draw” program in which organizations that already received a PPP loan could apply for a second if their organization employs 300 or fewer people and can demonstrate a 50-percent or more reduction in revenue, as called for in ASAE’s July 21 letter.

Two important notes:

- This language is the Senate Republicans’ initial marker for negotiations with Senate Democrats and the House. As you may recall, the House already passed the HEROES Act, which would expand eligibility under the PPP to all 501(c) nonprofit organizations of any size and with simpler lobbying restrictions. Focus is to help move negotiations as close to the HEROES Act marker as possible.

- While legislative language will be finalized in a few weeks, if PPP expansion to 501(c)(6) organizations indeed passes into law, such entities will need to move fast to secure PPP loans and the financial relief they need and are encouraged to consider options now so, if needed, you can expeditiously pursue PPP loan funds when the time comes.

Recovery Loans

Chairman Rubio’s bill would also authorize $100 billion in long-term, low-cost loans to help small businesses and seasonal businesses in lower-income areas (according to census data) recover. They would be available to employers with no more than 500 employees that can demonstrate a 50-percent reduction in gross revenues and meet the applicable SBA revenue size standard. Loans would be available up to twice the borrower’s annual revenue, capped at $10 million. The loans would have a 100 percent SBA guarantee, and a maturity of up to 20 years with a one-percent fixed interest rate.

Tax Credits

The HEALS Act proposes several important tax credits to provide additional financial relief:

- Expanded Employee Retention Tax Credit (ERTC)– The ERTC would be increased to 65 percent, up from 50 percent. This tax credit is available to employers for wages paid to employees if they have had to partially or fully suspend their business or if they have seen a significant decline in gross receipts. The required decline in gross receipts for eligibility would be reduced to 25 percent, down from 50 percent. The maximum amount of qualified wages would be increased to $30,000 this year, up from $10,000. Finally, the threshold for employees under which all wages are qualified for the credit would be raised to 500, up from 100. ASAE called for these expansions in its July 21 letter.

- Expanded Work Opportunity Tax Credit (WOTC)– The WOTC would be expanded to include qualified COVID unemployment insurance recipients hired prior to January 1, 2021. The credit amount applicable to this new group would be 50 percent of the first $10,000 in first-year wages.

- Safe and Healthy Workplace Tax Credit– The bill would establish a refundable payroll tax credit equal to 50 percent of an employer’s qualified employee protection expenses. These include personal protective equipment, cleaning supplies, COVID testing for employees and qualified workplace reconfiguration expenses. Each quarter, the credit cannot exceed the cap based on the number of employees. The cap is equal to $1,000 for each of the first 500 employees, plus $750 for each employee between 500 and 1000, plus $500 for each employee that exceeds 1,000. The credit would be available retroactive to March 12, 2020, and through January 1, 2021. ASAE called for such a proposal in its July 21 letter to Congress.

Other Provisions

In addition to the provisions outlined above, the HEALS Act includes, among many others, several broad provisions that would provide:

- Another round of stimulus check to qualified Americans;

- $200 federal unemployment benefit add-on for two months (down from the current $600/week set to expire this Friday);

- Liability protections for businesses that reopen in the pandemic;

- More than $100 billion for reopening schools and colleges;

- Flexibility for state and local aid; and

- Funds for testing and vaccines.

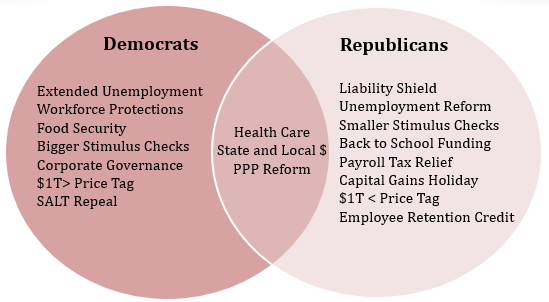

July 27 | Thorn Run Partners (TPR) provides a useful CARES 2.0 Summary. The image below provides an illustration of COFID-19 Relief Legislation: Potential Areas of Disagreement.

Congress is moving urgently to pass H.R, 6201, Families First Coronavirus Response Act (FFCRA), an economic recovery package that will address the effect of the COVID-19 coronavirus on the viability of business moving forward. It is expected to move quickly through the Senate and the President is expected to pass the law.

You can find the Summary of Latest Congressional Action on Coronavirus Response on the U.S. Chamber of Commerce, Combating the Coronavirus website.