Employers: Don’t let tax-related compliance requirements take your organization by surprise

Employers: Don’t let tax-related compliance requirements take your organization by surprise

With the U.S. Supreme Court upholding most provisions of the Patient Protection and Affordable Care Act of 2010 and President Obama being re-elected, it appears that the act is here to stay. Employers face a variety of tax-related compliance requirements under the act, perhaps the most notable of which is the “play or pay” provision that goes into effect in 2014. Certain small organizations, however, may be eligible for a tax-saving opportunity — even before 2014. Many of the health care act’s tax-related provisions require employers to act this year and next. So it’s important to take time now to determine what you need to do now and in 2014.

Here’s a closer look at key tax provisions and proposed IRS guidance (which can be relied on for filing purposes). Additional rules apply, so consult your tax advisor to determine exactly how your organization will be affected.

“Play or pay” provision

The shared responsibility provision, commonly referred to as “play or pay,” is scheduled to take effect Jan. 1, 2014. It doesn’t require employers to provide health care coverage, but it in some cases imposes penalties on larger employers that don’t offer coverage or that provide coverage that is “unaffordable” or that doesn’t provide “minimum value.”

Although the shared responsibility provisions don’t take effect until 2014, employers will use information about the workers they employ in 2013 to determine whether they’re subject to the provisions and face the potential for penalties in 2014.

Shared responsibility basics

Beginning on Jan. 1, 2014, the health care act requires “large” employers to offer a “minimum value” of “affordable” health coverage to their full-time employees or risk a penalty if at least one of their full-time employees receives a premium tax credit for purchasing individual coverage through one of the new affordable insurance exchanges. (Under the health care act, premium tax credits are available to employees who meet certain income requirements and don’t have access to a minimum value of affordable employer-provided insurance.)

A large employer is one with at least 50 full-time employees, or a combination of full-time and part-time employees that’s “equivalent” to at least 50 full-time employees. A full-time employee is someone employed on average at least 30 hours per week. The monthly equivalent of 30 hours per week is 130 hours of service in a calendar month.

Determining large employer status

Large employer status is determined in part by calculating full-time equivalent employees (FTEs). For a given calendar month, this requires totaling the hours of service for all part-time employees, and dividing that figure by 120.

For hourly employees, the hours should be calculated based on records of hours worked and hours for which payment is made or due for vacation, holiday, illness, incapacity (including disability), layoff, jury duty, military duty or leave of absence.

For salaried employees, there are three methods of determining the hours:

- The same method used for hourly employees,

- A days-worked equivalency method (each worker is credited with eight hours for each day worked), or

- A weeks-worked equivalency method (each worker is credited with 40 hours for each week worked).

You can apply different methods for different classifications of non-hourly employees, so long as the classifications are “reasonable and consistently applied.”

Employers must determine annually, based on their employees’ actual hours of service, whether they’ll be considered a large employer for the next year. For 2014, however, there’s transitional relief: Rather than considering all 12 months of 2013, you can use any six-consecutive-month period, subject to certain constraints. That means you could select six months toward the beginning of the year and use the remainder of 2013 to determine whether you need to offer coverage in 2014 and, if so, establish a compliant plan.

Assessing affordability and minimum value

A large employer that offers health coverage could nonetheless be subject to penalties if at least one full-time employee receives a premium tax credit because the coverage offered to the employee either wasn’t affordable or didn’t provide minimum value.

Generally, if an employee’s share of the premium would cost that employee more than 9.5% of his or her annual household income, the coverage isn’t considered affordable. There are three safe harbors that employers can use to satisfy the affordability requirement. An employer will avoid a penalty if:

The cost of the coverage won’t exceed 9.5% of the Form W-2 wages the employer pays the employee that year,

The employee’s monthly contribution amount for the self-only premium is equal to or lower than 9.5% of the computed monthly wages, or

The employee’s cost for self-only coverage doesn’t exceed 9.5% of the federal poverty line for a single individual.

The affordability test applies to the lowest cost option available to the employee that also meets the minimum value requirement.

Under the minimum value requirement, a health plan must cover at least 60% of the total allowed costs of benefits provided under the plan. The IRS and the U.S. Department of Health and Human Services will make available an online minimum value calculator where employers can enter certain plan information and obtain a determination of whether the plan provides minimum value.

Calculating penalties

For large employers that don’t provide at least 95% of their full-time employees (and, after 2014, their dependents, defined as an employee’s children under age 26) with health coverage and have one or more of these employees who receive a premium tax credit, the annual penalty is $2,000 per full-time employee in excess of 30 full-time employees. Note that there’s an exception for certain employers that don’t meet the 95% requirement but exclude no more than five employees.

For large employers that do provide at least 95% of their full-time employees (and, after 2014, their dependents) with coverage but this coverage is deemed not to be affordable or not to provide minimum value, the penalty is the lesser of $3,000 for each employee receiving a premium tax credit or $2,000 for each full-time employee beyond the first 30 full-time employees.

For purposes of penalty calculations, full-time employees don’t include FTEs, but only actual full-time employees (again, those averaging 130 hours or more per month). Penalties will increase annually based on premium growth.

Moving forward

Some employers may opt to simply pay the penalties because the increased costs due to the broader scope of coverage now required (for example, coverage of dependents up to age 26) may be greater than the penalties. These employers could incur other costs, though, such as lost tax benefits (unlike health care benefits, penalties aren’t deductible) and the costs to remain competitive in the labor market. Other employers may consider making adjustments to their workforces in an effort to reduce their FTEs and avoid being considered a large employer. But this may be easier in theory than in practice. (See the Case Study below.) •

Case Study — Reducing FTEs to avoid “play-or-pay” provision

If you’re over — but not too far over — the 50 full-time equivalent employee (FTE) threshold for the play-or-pay provision, you might be able to make some adjustments to your workforce to avoid hitting the threshold and being at risk for penalties. But it’s not as simple as reducing employees’ hours and hiring more part-timers.

For example, a grocery store with 40 part-timers who average 90 hours per month would have 30 FTEs (40 × 90 = 3,600; 3,600/120 = 30) who must be added to the number of full-time employees (those working at least 130 hours during the month) when determining whether the 50-FTE threshold is met. If the store reduced the average hours by half and doubled its part-time workforce in order to cover the same hours, the result would be the same 30 FTEs (80 × 45 hours = 3,600; 3,600/120 = 30).

In other words, when it comes to part-time employees, it’s the total number of hours worked by all part-timers that is critical, not the number of part-timers or how many hours each part-timer works.

Converting some full-time employees to part-timers also might not have as much of an impact as you’d think. For example, if a business converts five full-timers to part-timers by reducing their average hours from 130 to 96 hours per month, that would still be 4 FTEs (5 × 96 = 480; 480/120 = 4). So the business would have only 20% fewer FTEs even though it reduced hours by about 26%. If the full-timers had been working 40 hours per week, the hour reduction would be even greater yet produce the same 20% reduction in FTEs.

So before cutting employee hours in an effort to avoid penalties, it’s important to look carefully at the extent to which doing so would actually reduce your FTEs — as well as the other ways the reduction would affect your organization.

Changes to the health care coverage credit

While smaller employers don’t have to worry about the penalties going into effect in 2014, some do need to be aware of changes to the health care coverage tax credit that also take effect in 2014. And if your organization is eligible for the tax credit but hasn’t taken advantage of it, you should consider doing so in 2013 — and see if you can file an amended return to claim the credit for previous years.

The credit through 2013

The health care act provision providing tax credits to qualifying small employers took effect in 2010. Employers with fewer than 25 FTEs and average annual wages of less than $50,000 that pay at least half of the cost of health insurance for their employees may qualify.

Through 2013, the credit for businesses, which reduces income tax liability dollar-for-dollar, is for up to 35% of the cost of group health coverage. For nonprofits, the benefit is a little different:

- The maximum credit is 25% of qualified costs through 2013.

- Because nonprofits generally don’t pay income tax, the credit offsets their withholding tax liability.

Whether business or nonprofit, qualifying organizations with 10 or fewer FTEs and average annual wages of less than $25,000 can claim the maximum applicable credit. Qualifying organizations that exceed either threshold are entitled to partial credits on a sliding scale, and the credit is phased out altogether when an organization reaches 25 FTEs or average annual wages of $50,000.

The number of FTEs is determined slightly differently than for play-or-pay provision purposes, by calculating the total hours of service for which your organization pays wages to employees during the year (but not more than 2,080 for any one employee), and then dividing that figure by 2,080.

Only the employer’s portion of health insurance premiums counts in calculating the credit. And that amount is further limited to the amount the employer would have paid based on the average premium for the small group market in the employer’s state or area, if it’s less than the actual premium. (See the Case Study below.)

2014 and later

After 2013, some additional changes to the credit go into effect:

Coverage must be purchased through a state (or federal) exchange. The health care act intended that state governments would establish and run the affordable insurance exchanges, but the federal government agreed to launch and handle them in states that couldn’t (or wouldn’t) set one up. The federal government may, in fact, end up running about half of the exchanges nationwide. Only qualifying employers that purchase coverage through an exchange will be eligible for the credit.

The maximum credit increases. It can be as much as 50% of a business’s contributions toward the health insurance premiums. For nonprofits, the maximum credit becomes 35%.

The credit can be taken for only two years. There is no requirement as to which two years must be chosen. Thus, some planning should be involved in determining when to claim the credit. That is, if the credit will be reduced in a particular year due to one or more of the various limits that apply, the employer may be better off waiting until the next year to see if the credit will be more valuable. •

Case Study — Calculating the health care coverage credit

For the 2013 tax year, Acme offers its employees a group health plan with single and family coverage and pays 50% of the premiums. Acme has 10 full-time equivalent employees with average annual wages of $23,000. Six employees are enrolled in single coverage and four are enrolled in family coverage. Total premiums are $4,000 a year for single coverage and $10,000 a year for family coverage.

Average premiums for the small group market in Acme’s state are $5,000 and $12,000, respectively. Acme’s premium payments ($2,000 for single coverage and $5,000 for family coverage) don’t exceed 50% of these averages, so it computes the credit based on its actual premium payments of $32,000 (6 × $2,000 + 4 × $5,000). Acme’s tax credit is $11,200 ($32,000 × 35%).

Increased Medicare tax withholding in 2013

Under the Federal Insurance Contributions Act (FICA), wages are subject to a 2.9% Medicare tax — 1.45% paid by the employers and 1.45% withheld from the employees’ wages. Under the health care act, starting in 2013, taxpayers with FICA wages over $200,000 per year ($250,000 for joint filers and $125,000 for married filing separately) must pay an additional 0.9% Medicare tax on the excess earnings.

Unlike regular Medicare taxes, the additional Medicare tax doesn’t include a corresponding employer portion. But employers are obligated to withhold the additional tax to the extent that an employee’s wages exceed $200,000 in a calendar year.

Withholding requirements

You aren’t required to begin withholding additional Medicare tax until the pay period in which you pay wages in excess of $200,000 to an employee. But the $200,000 threshold applies without regard to the employee’s filing status or income from other sources.

So in some cases you’ll be required to withhold the tax from wages paid to employees who aren’t liable for it — because, for example, their wages, together with those of their spouses, don’t exceed the $250,000 threshold for joint filers. In this situation an employee can’t ask you to stop withholding the tax. Rather, the employee can recover the tax by claiming a credit on his or her income tax return for the year.

It’s also possible that no additional Medicare tax will be withheld from employees who are liable for the tax. This could occur if the combined earnings of a married couple filing jointly exceed $250,000 but neither spouse’s wages are more than $200,000 or if an individual has two jobs and neither job pays wages in excess of the threshold.

Employees who anticipate additional Medicare tax liability can’t request that you withhold additional amounts specifically for the tax. They can, however, use Form W-4 to request additional income tax withholding sufficient to cover their liability for the additional Medicare tax.

Adjustments and refund claims

It’s critical to follow the withholding requirements, because an employer that fails to do so is liable for additional Medicare tax, plus all applicable penalties. If the employee pays the tax, the employer is relieved of liability for the tax but may still be subject to penalties.

You can make interest-free adjustments in the event of underpayments or overpayments of additional Medicare tax compared to your withholding obligations. Generally, this is done by filing the appropriate corrected return (for example, Form 941-X) and reimbursing overpaid amounts to the employee or collecting underpaid amounts from the employee’s wages before year end.

Underpayments may be adjusted only if the error occurs during the same year the underlying wages were paid (with certain exceptions, including underpayments attributable to administrative errors or IRS examinations). You’re liable for the correct amount of tax, even if you’re unable to deduct the underpaid tax from the employee’s wages.

Overpayments may be adjusted if you ascertain the error in the year the wages were paid and reimburse the employee for over-collected amounts by year end. If you’re unable to reimburse the employee by year end, you shouldn’t make an adjustment. Instead, you should report the amount withheld on the employee’s W-2 so the employee can obtain a credit on his or her individual income tax return.

You can claim a refund of overpaid additional Medicare tax, provided you didn’t deduct or withhold the overpaid amounts from the employee’s wages.

Other changes going into effect in 2013

Some other tax-related health care act provisions go into effect in 2013 that you need to be aware of.

W-2 reporting

A requirement that may already have affected your organization is related to W-2 reporting: Employers that filed 250 or more 2011 W-2 forms must begin reporting the cost of employer-provided health care coverage on the forms beginning with the 2012 tax year — that means the W-2s distributed in January 2013.

As explained in IRS Notice 2011-28, the new requirement calls for informational reporting only — it doesn’t cause excludable benefits to become taxable or change the tax treatment in any way. The purpose of the requirement is “to provide useful and comparable consumer information to employees on the cost of their health care coverage.”

If the IRS decides to extend the reporting requirement to smaller employers for the 2013 W-2s that will be furnished in January 2014, it must issue guidance before June 30, 2013.

FSA compliance

Health care Flexible Spending Accounts (FSAs) allow employees to redirect pretax income to an employer-sponsored plan that pays, or reimburses them for, qualified medical expenses not covered by insurance. Through 2012, employers offering health care FSAs had been allowed to set whatever employee contribution limit they wished. But starting in 2013 the maximum limit is $2,500. Employers can set a lower limit, however.

According to the IRS, the new limit applies on a plan year basis. Thus, non-calendar-year plans must comply for the plan year that starts in 2013.

Employers will need to amend their plans and summary plan descriptions to reflect the $2,500 limit (or a lower one, if they wish) by Dec. 31, 2014, and institute measures to ensure employees don’t elect contributions that exceed the limit. Note that there will continue to be no limit on employer contributions to FSAs.

This publication was developed by a third-party publisher and is distributed with the understanding that the publisher and distributor are not rendering legal, accounting or other professional advice or opinions on specific facts or matters and recommend you consult an attorney, accountant, tax professional, financial advisor or other appropriate industry professional. This publication reflects tax law as of Feb. 15, 2013. Some material may be affected by subsequent changes in the laws or in the interpretation of such laws. Therefore, the services of a legal or tax advisor should be sought before implementing any ideas contained in this publication. ©2013

SACU and ARMA volunteers will provide free secure shredding services to individuals at six SACU branches on Saturday, April 20, from 9 am – 12 noon, or until the trucks are filled. Branches include Main, 281/1604, Bandera, Ingram, Southside and Windsor. Visit sacu.com to find the branch location nearest you.

SACU and ARMA volunteers will provide free secure shredding services to individuals at six SACU branches on Saturday, April 20, from 9 am – 12 noon, or until the trucks are filled. Branches include Main, 281/1604, Bandera, Ingram, Southside and Windsor. Visit sacu.com to find the branch location nearest you.

This year is off and running and it’s hard to believe we find ourselves starting the second quarter already. April brings many exciting initiatives, updates and opportunities to our membership. The North Chamber will be participating in Fiesta for the first time this year and we invite you to join us in that effort. Additionally, our Government Affairs Council endorsed the City of San Antonio’s local preference program, which passed in March, and North Chamber event season is in full swing.

This year is off and running and it’s hard to believe we find ourselves starting the second quarter already. April brings many exciting initiatives, updates and opportunities to our membership. The North Chamber will be participating in Fiesta for the first time this year and we invite you to join us in that effort. Additionally, our Government Affairs Council endorsed the City of San Antonio’s local preference program, which passed in March, and North Chamber event season is in full swing. Expansion to Meet the Stone Oaks area’s growing need for women’s services.

Expansion to Meet the Stone Oaks area’s growing need for women’s services.

Employers: Don’t let tax-related compliance requirements take your organization by surprise

Employers: Don’t let tax-related compliance requirements take your organization by surprise

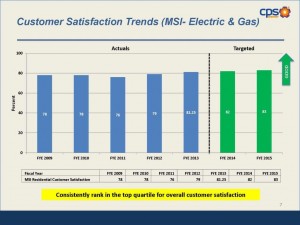

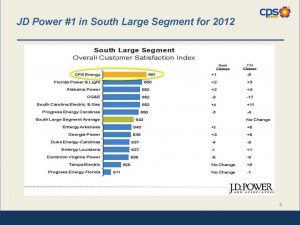

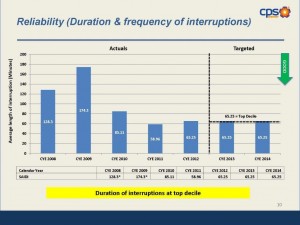

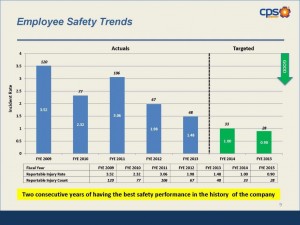

CPS Energy’s electric reliability is within the top tier of the industry, its employees have increased safety to a record high for the second year in a row, and customer satisfaction remains high.

CPS Energy’s electric reliability is within the top tier of the industry, its employees have increased safety to a record high for the second year in a row, and customer satisfaction remains high.

Security Service Federal Credit Union is proud to fuel the Texas Bowties First Generation Camaro Club’s Third Annual Spring Open Car Show as its title sponsor. Steer your way to this family-friendly event on Sunday, April 14, 2013 at Ancira Winton Chevrolet, 6111 Bandera Road, from 8 a.m. to 4 p.m. Once there, you’ll want to race straight to the lot full of sweet rides from the winner’s circle, including Camaro, Corvette, Chevelle, Chevy, Mustang, Mopar, street rod, trucks, antiques, and more.

Security Service Federal Credit Union is proud to fuel the Texas Bowties First Generation Camaro Club’s Third Annual Spring Open Car Show as its title sponsor. Steer your way to this family-friendly event on Sunday, April 14, 2013 at Ancira Winton Chevrolet, 6111 Bandera Road, from 8 a.m. to 4 p.m. Once there, you’ll want to race straight to the lot full of sweet rides from the winner’s circle, including Camaro, Corvette, Chevelle, Chevy, Mustang, Mopar, street rod, trucks, antiques, and more.

Methodist Healthcare has named Candie Starr, MHA, BS(MT), as chief operating officer and ethics and compliance officer at Methodist Stone Oak Hospital.

Methodist Healthcare has named Candie Starr, MHA, BS(MT), as chief operating officer and ethics and compliance officer at Methodist Stone Oak Hospital. Starr has served on the Joint Commission’s Board of Advisors, HealthTrust Purchasing Group Advisory Boards, the board of the United Way, and on the boards of several community blood banks.

Starr has served on the Joint Commission’s Board of Advisors, HealthTrust Purchasing Group Advisory Boards, the board of the United Way, and on the boards of several community blood banks. On March 1, 2013, The Alternative Board (TAB) of San Antonio held its 16th Anniversary Celebration dinner at the Petroleum Club. During the event, several TAB members were recognized for their contributions to the success of the organization. PS&Co.’s Managing Partner, John Wright, was honored as the Most Valuable Member of the CEO Board 503!

On March 1, 2013, The Alternative Board (TAB) of San Antonio held its 16th Anniversary Celebration dinner at the Petroleum Club. During the event, several TAB members were recognized for their contributions to the success of the organization. PS&Co.’s Managing Partner, John Wright, was honored as the Most Valuable Member of the CEO Board 503! At the end of 2012, each board member voted by private ballot for the “Most Valuable Member,” the “Most Interesting Member,” the “Most Improved Company,” “Community Service,” “TAB Booster,” and “Comeback of the Year.”

At the end of 2012, each board member voted by private ballot for the “Most Valuable Member,” the “Most Interesting Member,” the “Most Improved Company,” “Community Service,” “TAB Booster,” and “Comeback of the Year.”